As a stock investor and trader, you may have considered at some point whether it is worth investing in an IPO.

After all, there is a lot of hype surrounding IPOs. And when a company goes public, there is usually a big first-day pop in the stock price.

To answer the question of whether it’s worth investing into an IPO, there are a few things to consider. Let’s take a look at some of those things in today’s post…

What Is An IPO?

An Initial Public Offering (IPO) is when a company first sells shares of stock to the public.

When a company decides to become publicly listed on an exchange and offer its shares for sale to the investing public it is said to have “issued an IPO.”

Why Do Companies Go Public?

There are many reasons why companies choose to go public. Some companies need to raise money to finance growth or expansion. Others want to provide liquidity for their shareholders, or employees who have stock options. And going public can also help a company increase its visibility and prestige.

Why Do Investors Buy IPOs?

Investors buy IPOs for a variety of reasons. Some investors think that buying shares in a new company is a great way to get in on the ground floor of a promising business. Others believe that IPOs offer the potential for high returns, since many new companies see their stock prices increase sharply after going public.

However, as we’ll find out, things don’t always work out that way – many stock prices end up tanking after their IPO. In fact, the highest returns are generally made by angel investors and venture capital funds that invested into these companies in their very early stages long before they became publicly listed.

What Are The Risks Of Investing In IPOs?

Of course, there are also risks involved in investing in IPOs.

For one thing, it can be difficult to predict which new companies will be successful and which will flop. Additionally, even successful companies often see their stock prices drop after the initial excitement of the IPO wears off.

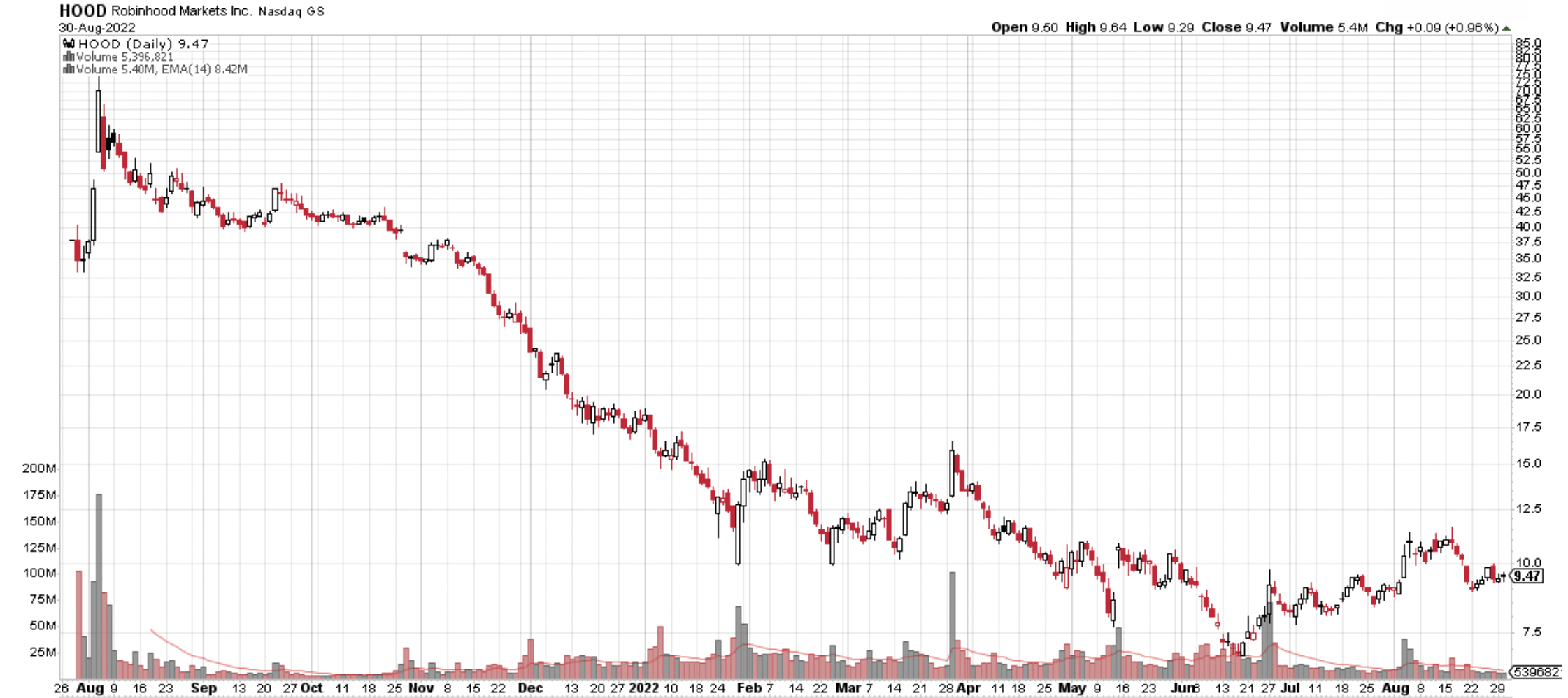

A good example of this is Robinhood (HOOD), whose stock price has consistently fallen after its initial public offering in July 2021. Here’s the stock chart of its price as of August 2022.

As you can see, there was an initial spike in the stock price right after the stock went public, only to continually decrease ever since. This initial spike is most likely due to amateur investors being sold into the media hype and purchasing Robinhood shares without doing any research, driving up the stock price. Likewise, the subsequent decrease is most likely due to the angel investors and venture capital funds selling off their stakes for great profits.

So it goes without saying, investors need to be aware of the risks before they decide to buy shares in an IPO.

Is It Worth Investing In IPOs?

Whether or not investing in IPOs is worth it depends on the individual investor’s risk tolerance and goals. For some investors, the potential rewards of investing in an IPO may outweigh the risks. But for others, the reverse may be true. So, it’s important for investors to do their research and understand the risks before they invest in any IPO.

When considering buying initial public offerings (IPOs), it is essential to understand what we are getting ourselves into.

There are many lead managers and lawyers making money on IPOs, but for the rest of us, the investors, it isn’t always the case. It’s easy to wind up buying over-priced companies tied to less-than-inspiring sectors (the media and hype surrounding some of these IPOs certainly doesn’t help).

There are endless numbers of IPOs on the ASX, NYSE, or NASDAQ that seemed promising, but wound either sputtering along above the issue price for a short time and then crashed or it simply took a nose dive out of the gate.

So, what do we need to know about future IPOs comprised of tech-stocks, LICs, telcos, agri-stocks and resource stocks? Let’s explore some guidelines…

8 Things You Must Consider Before Buying IPOs

Do the research

We should never jump into buying anything before doing our homework. Always look into prior financial statements of companies. Also, make sure to investigate what the money being raised is going to fund. Is it to pay for expansion? For repaying debt? We should also determine how much is to be paid to existing owners. My suggestion is to consult with trusted investing professionals before spending any money.

Time it right

Especially when a stock looks over-priced, if an IPO that is otherwise good seems like it is going to wind up riding the waves in a negative market, then we may want to buy the stock on-market after it is listed. We should also do a comparison between its likely issue price and the issue prices of similar stocks on the market. If we find that there’s a clear premium, we should do our best to determine whether it’s warranted in relation to its current and future potential earnings.

Think twice about stagging

Purchasing IPO’s for ‘stag’ profits (i.e. purchasing brand new shares and selling immediately for profit) in light of how many stocks trade lower than their float price (i.e. initial listing price) is not a good strategy.

Balance sheet basics

We should be looking for the floats of companies that have little debt, not a lot of goodwill and a consistent, better than average return on equity (ROE) on their balance sheet. Also, it is important to stay away from floats that have negative net tangible assets (NTA) or negative net worth (pre-IPO).

Taking the IPO prospectus at face value

A prospectus is a legal document companies prepare to provide information about an investment offering for sale to the public. Think of it as sort of an advertising pamphlet for why you should invest.

Never take a prospectus at face value. According to the Australian Securities and Investment Commission (ASIC), approximately one-third of float prospectus were misleading to investors. When reading a prospectus, if we find that the projected earnings of a company seem to be ridiculously high in comparison to its recent history, we should be raising questions.

Who are the ones exiting?

Especially when a listing’s owners are a private equity firm (i.e. companies that buy mature companies and flip them for profit) lining up to make their exit, we need to make sure that an IPO is worthy of investment and are priced attractively. It’s time to reconsider buying into a float when it appears that the people charged with turning a company around are heading for the door.

Look at the big picture

It is essential that we look at all of the factors that are likely to have a negative impact upon a company’s business model and core earnings. What threats may be posed by future technology or new entrant disruptors? What will be the sources of future growth? What is the ‘defensibility’ of any existing competitive advantage?

These are questions all angel investors and venture capital funds ask in the early stages of a company before it becomes listed, and it’s just as important for you to do the same.

Being a healthy skeptic

The largest risks when buying into an IPO is what the company isn’t telling us. When looking into a company, it is our responsibility to identify what it is that his not being revealed to us. Warren Buffet, a famous value investor said, “It’s almost a mathematical impossibility to imagine that, out of the thousands of things for sale on a given day, the most attractively priced is the one being sold by a knowledgeable seller to a less-knowledgeable buyer.”

Put another way, a company isn’t bringing a stock to market because they want to help us, their investors. They are doing it because they want to draw us in and have us put our money into their company.

So it’s highly important that we do our research and make informed decisions, rather than get caught up in media hype surrounding an IPO.

Learn how to Screen Out the Best Companies to Invest In

Opportunities to buy into IPOs generally come about as a result of media hype. During these times, it’s not uncommon to hear ‘hot stock tips’ or news around ‘the next big opportunity.’

Snapchat is another one of these examples – it was highly anticipated to be the ‘next best social media platform that would take over Facebook’ right before its IPO. But, if you looked closely at the right places, you would have seen from a mile away, that it was a terrible opportunity sensationalized by the media.

If you’d like to learn how to filter legitimate ‘hot stock tips’ from the false ones, I’d like to invite you to attend my upcoming FREE 90-Minute Online Masterclass.

It’s a highly interactive class, complete with your own downloadable workbook, and I guarantee you’ll walk out of the Masterclass with a completely different filter of the trading and investing world.

If you’d like to join me, book your spot here, and I’ll see you on the other side.

Terry