It’s happened to the best of us.

We’ve all been there, scrolling through our phones or laptops and checking our portfolios only to see that one stock we bought has suddenly lost a ton of value.

For new stock traders, it can be incredibly discouraging – especially when you’re not entirely sure why your investment has taken a nosedive. If this describes you, then stop loss orders may be worth learning more about.

In this post, we’ll break down what stop loss orders are and how they can help minimise losses for stock traders.

Stay tuned!

What is a Stop Loss Order and Why do Traders Use Them?

A stop loss order is an order placed with a broker to sell a stock when it reaches a certain price.

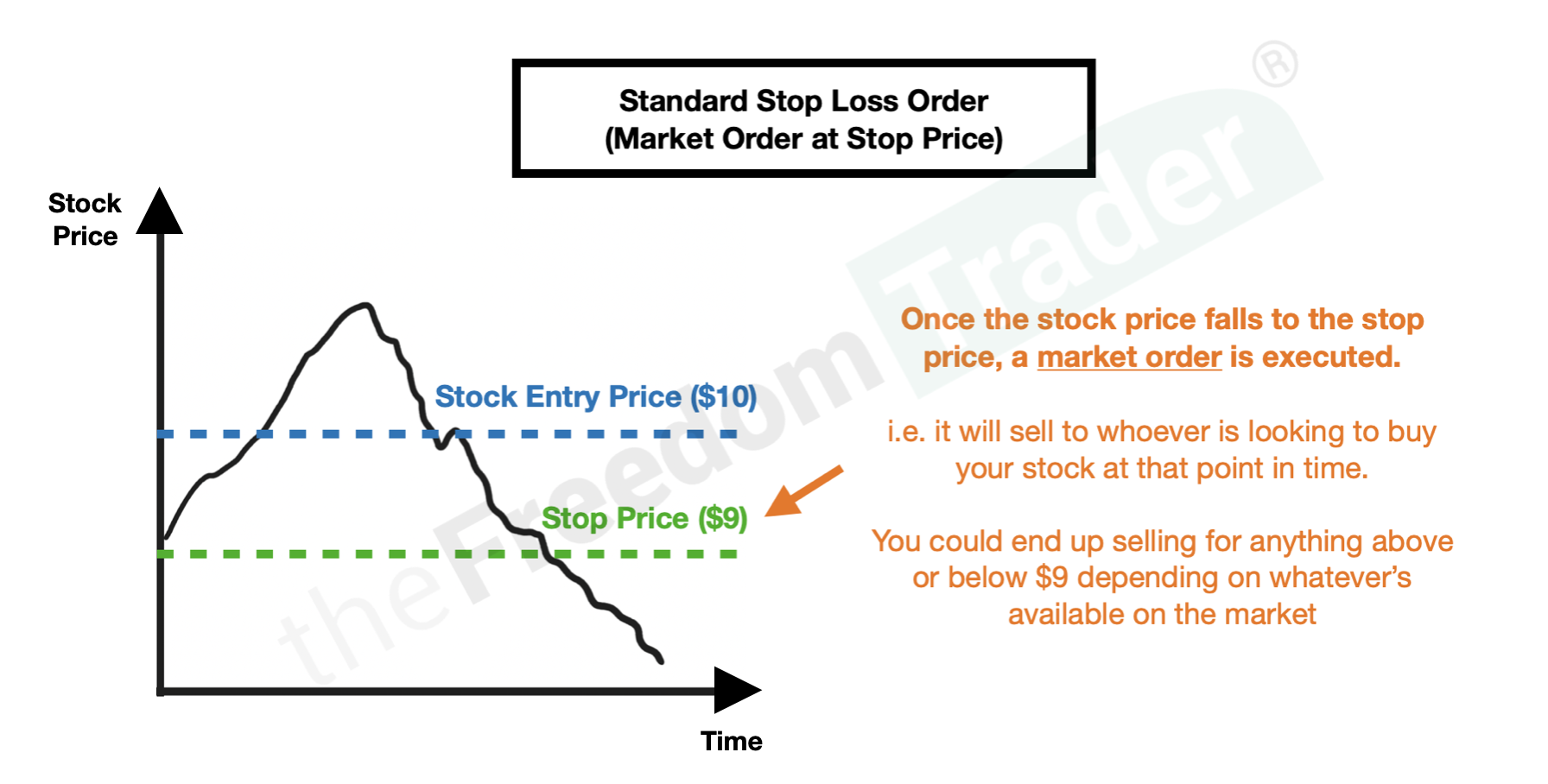

Stop loss orders are designed to limit an investor’s loss on a stock position. When the stop price (the price you set the stop loss order at) is reached, a stop loss order becomes a market order (i.e. an order to sell at current market prices) and is executed at the market price then.

Many stock traders use stop loss orders as a way to limit their potential losses on a trade. In most cases, stop loss orders are placed below the current market price of the security.

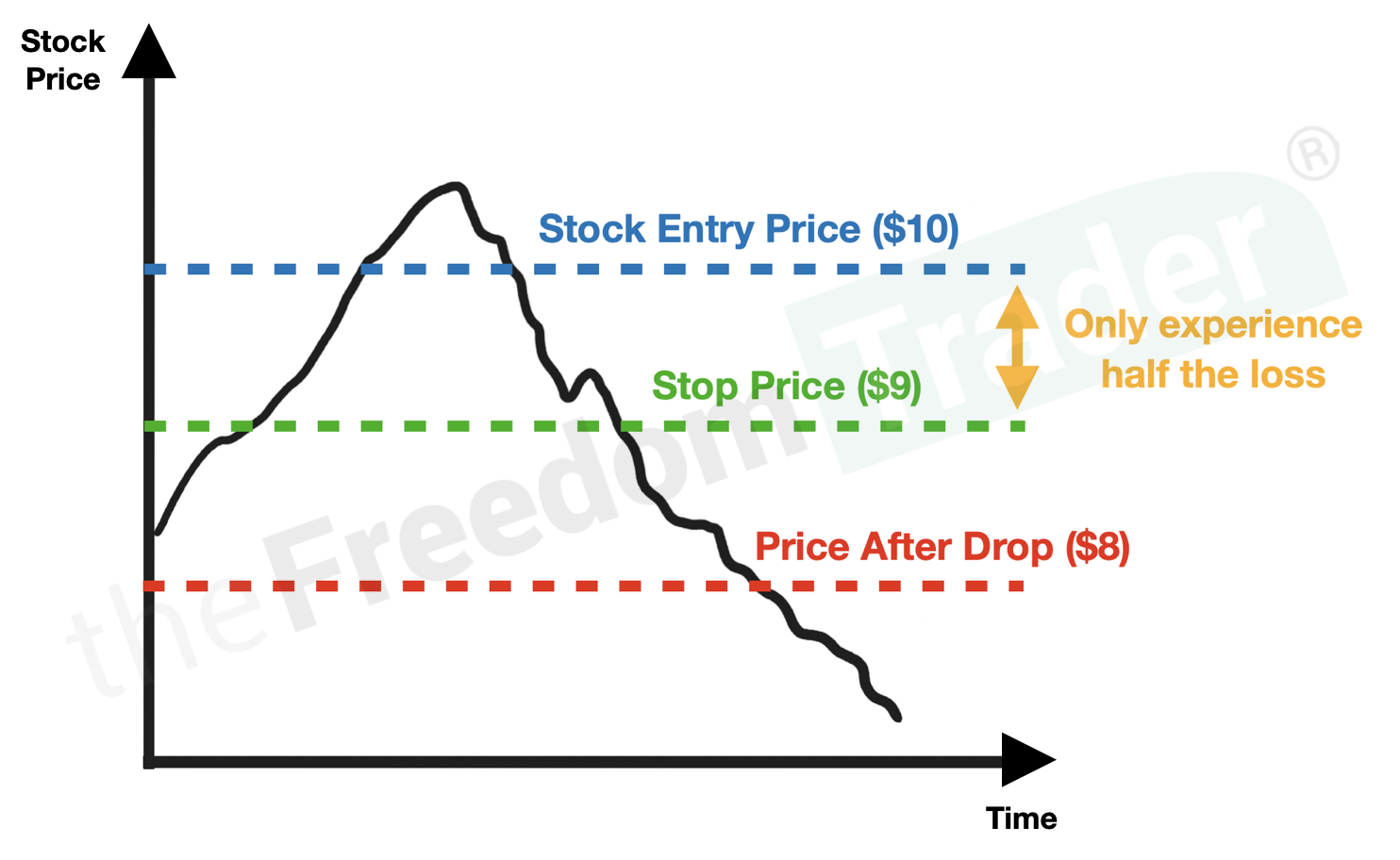

For example, let’s say you buy shares of Company XYZ at $10 per share. If you place a stop loss order at $9 per share and the stock price drops to $8, instead of losing $2, you would limit your loss on the trade to $1 per share.

Advantages and Disadvantages of Stop Loss Orders

There are both advantages and disadvantages to using stop loss orders.

Advantages

- Limiting losses – as we’ve already mentioned, the main benefit of stop loss orders is they can help limit your losses on a trade.

- Allows emotional detachment from trades – they can also take the emotion out of trading – once you’ve placed a stop loss order, you don’t have to worry about what happens to the stock price after that point.

- Automated – On top of that, the automated aspect of it means stop loss orders can free up your time so that you don’t have to constantly monitor your positions.

Disadvantages

- Stops aren’t always guaranteed – the issue with standard stop loss orders is that they don’t guarantee that you’ll sell your shares at the stop price you set – if the stock price gaps down (meaning it opens at a lower price than it closed the previous day), your stop loss order may be executed at a lower price than you intended. I’ll provide an example of this later.

- Stops can trigger randomly at the wrong time – stop loss orders may be triggered by temporary abrupt market fluctuations (usually during high market volatility) that ultimately reverse course – this is known as whipsawing.

- You can miss out on profits with normal fluctuations – you may miss out on profits if a stock price rebounds after briefly dipping below your stop price.

How to Place a Stop Loss Order

Now that we’ve gone over what stop loss orders are and some of the pros and cons of using them, let’s take a look at how to actually place one.

If you’re interested in placing a stop loss order, the first step is to find a broker that offers this type of order. Not all brokers offer stop loss orders, so it’s important to do your research before opening an account.

Once you’ve found a broker that offers stop loss orders, the process for placing one is typically pretty straightforward and is typically free to set up.

When placing a stop loss order, you’ll need to provide your broker with the following information:

- The stock symbol of the security you want to place a stop loss order on (e.g. MSFT for Microsoft)

- The number of shares you want to sell

- The stop price (the price at which you want your shares to be sold) – you can do this as a specific dollar amount, or, as I prefer, a maximum percentage decrease you’ll allow before the stop comes into effect

- The duration of the order (how long you want the order to remain in effect)

The Different Types and Variations of Stop Loss Orders

It’s also important to note that there are different types of stop loss orders.

Standard Stop Loss Orders

A standard stop loss order is executed at the specified price, but may not always do so (i.e. when the stock price gaps down).

For example, if you place a standard stop loss order to sell shares of Company XYZ at $9 and the stock trades at $8.50, your shares could be sold at $8.50.

Guaranteed Stop Loss Orders

A guaranteed stop loss order is executed at the specified price regardless of market conditions.

For example, if you place a guaranteed stop loss order to sell shares of Company XYZ at $9 and the stock trades at $8.50, your shares will still be sold at $9.

This is much better than standard stop losses, but typically incurs a premium fee for this privilege.

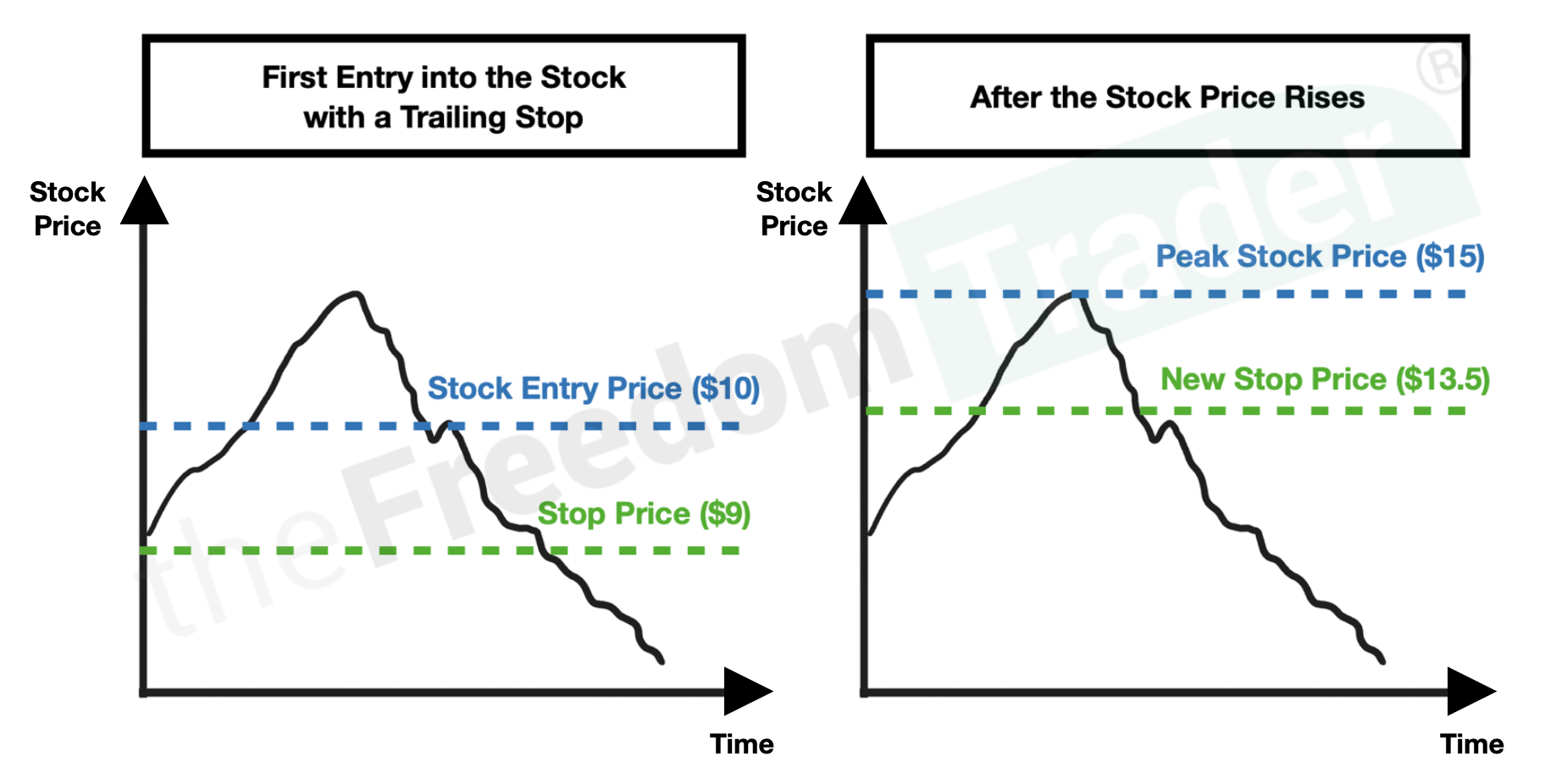

Trailing Stop Loss Orders

A trailing stop loss order is a stop loss order that “trails” or follows the stock price by a certain percentage or dollar amount.

For example, let’s say you buy shares of Company XYZ at $10 per share and place a trailing stop loss order with a 10% trailing stop. This means that if the stock price falls 10% from its highest point since you bought it, your shares will be sold. So, if the stock price reaches $15 per share at any point, your stop price will automatically adjust to $13 per share.

The main advantage of a trailing stop loss order is that it can help protect your profits while still allowing your trade to continue to move in your favour.

A Common Point Of Confusion: Stop Loss Orders vs Stop Limit Orders

It’s important to note that stop loss orders are different from stop limit orders, although the two are often confused.

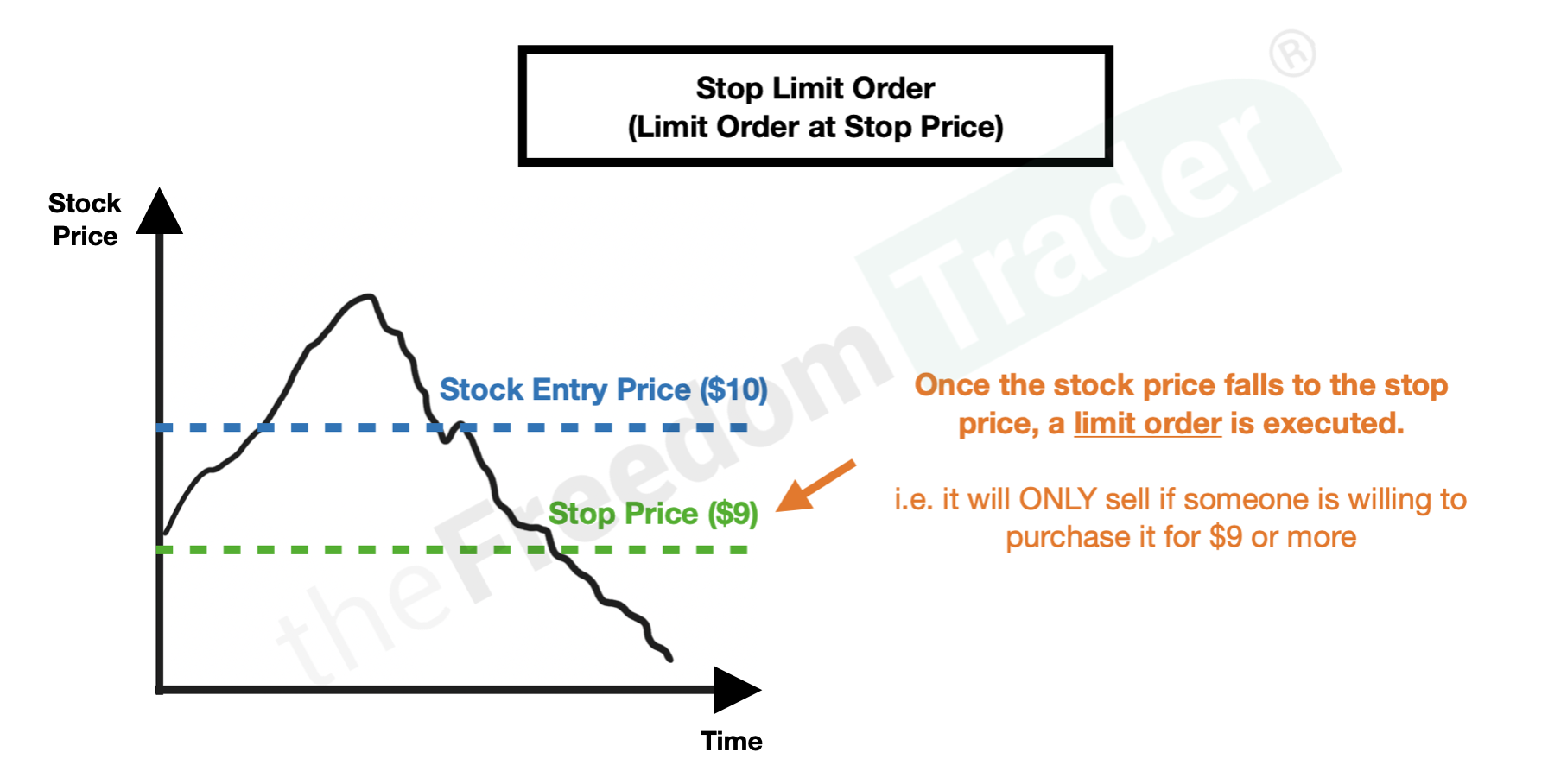

A stop limit order is essentially the same thing as stop loss order – the only difference is the type of order that gets carried out when the stop price is reached.

Normally, a stop loss order will execute what’s called a market order when the stop price has been reached. This means it will sell your stock position at whatever the current market price is at that time – it will sell, just not necessarily at the stop price you’ve set (unless you use a guaranteed stop loss order).

A stop limit order, on the other hand, will execute what’s called a limit order when the stop price has been reached. This means it will only sell your stock position if the stock price is at or above the limit price you’ve set – there’s no guarantee that it will sell at all.

For example, if you place a stop limit order to buy shares of Company XYZ at $9 with a stop price of $8, your order will only be executed if and when the stock trades at $9 or higher. If the stock trades at $8.50, your order will not be executed.

When Should You Use a Stop Loss Order ?

There is no right or wrong answer to this question – it depends on your trading strategy and risk tolerance. Some stock traders use stop loss orders on every trade, while others only use them on a select few trades.

Personally, I only use stop loss orders for shorter-term trades that are weaker on the fundamentals (i.e. they’re not financially robust companies). For my medium to longer-term investments, I don’t use them at all as they have a better chance of recovering over time.

The reason I say this is because I only invest in financially robust companies that I am confident will do well over the long-term, so even if they take a few hits along the way, I am convinced they will bounce back.

If you’re curious how I determine whether a stock is financially robust or not, you can check out my 10 Must-Have Stock Criteria Checklist here.

5 Common Misconceptions About Stop Loss Orders

Now that we’ve covered the basics of stop loss orders, let’s dispel some common myths about them.

“I Can Place a Stop Loss Order for Any Stock I Want”

Not all stocks have stop loss orders available. For example, penny stocks typically don’t have them. To find out if a stop loss order is available for a particular stock, you’ll need to contact your broker or check their website or trading platform.

“I Have to Place My Stop Loss Order When I Buy the Stock”

This is not true. You can place a stop loss order at any time – even after you’ve already bought the stock.

“Mental Stop Losses Are Adequate”

To counteract some of the downsides of stop losses (i.e. being sold out too early because of a price fluctuation triggering the stop loss order), some stock investors and traders are convinced they can just use a mental stop loss.

A mental stop loss is essentially just keeping your stop price in your mind (or as a reminder somewhere else) and deciding to manually click the sell button once the stock position has reached that point – that way, you can adjust to market conditions and be flexible to market changes as they happen.

Here’s the thing though: mental stops are easy in theory, but hard in practice.

Why?

Just imagine you have just bought a stock you think will go up and you have a mental stop you say to yourself I will get out at XYZ price. Instead, the moment you buy the stock, it begins its downward decent and has now lost 10% of its value due to some bad news. How would you feel?

It has just passed your mental stop loss and you are ready to ‘calmly’ put on the order to exit the position and move onto the next trade right?

I will tell you from experience even after two decades of being involved in the market, all calmness goes away when you are put on the spot and money has now been lost.

The majority of the time, traders with mental stop losses are likely to switch to a hold-and-pray decision, hoping to recuperate from their losses, and justifying their decisions under the façade of being “flexible with the market.”

Losses and bad trades are part of the stock investment and trading game. It’s much better to just use the actual stop loss, stay emotionally detached from your trades, and move on.

“Why Even Think About Losses? Just Focus On Profits”

This is more a faulty mindset rather than misconception.

For some people, stop losses just aren’t something they want to consider, and understandably so.

This is because stop losses force us to crystalize a trade gone wrong.

But stop losses are like insurance. It’s not always pleasant to think about the downside, but it’s important to prepare in advance so you don’t get caught up with your emotions if something does end up going wrong.

They are important because they protect not just the position you are currently in, but also the overall portfolio from ever having one bad trade ballooning into a disaster and affecting not just the trade but now the entire portfolio.

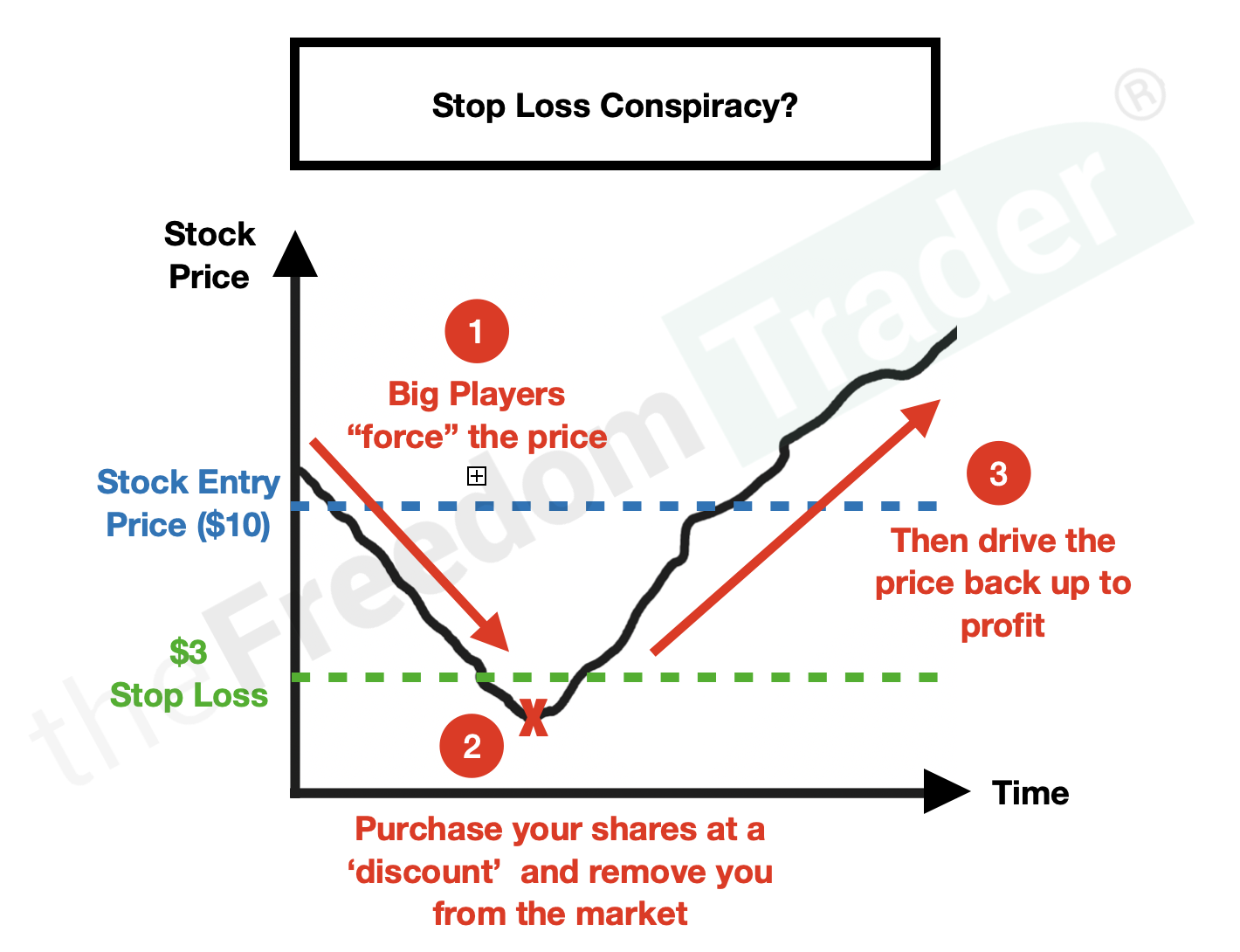

“Big Players Will Conspire Against You”

Another common myth is that once you set a stop loss order, the whole market gets to see your order and hence all the big market participants will conspire to drive down the stock you hold and hit your stop loss at the exact price to take your stock on the cheap, before running the stock back up.

This means you are immediately doomed for loss and failure and are at the mercy of the big players that supposedly control the market.

This is ludicrous, especially if you are trading in very large cap stocks (i.e. stocks from the biggest companies on the market) like those within the S&P500 index.

Can you imagine the amount of stock that needs to be sold just to ‘force’ the stock down to your price so they can buy the small amount you hold?

This doesn’t even sound rational, does it? I can tell you this will not happen with large cap stocks. But it can definitely happen on small cap illiquid stocks.

The Bottom Line

Stop loss orders are a valuable tool that can help you minimise losses on your trades. But they’re not enough on their own.

It’s also important (and I would argue it’s much more important) to ensure that:

- you’re using stop losses on stocks you’ve researched beforehand

- to understand market movements so you can time your entry and exit

In other words, stop losses are an extra layer protection on top of your fundamenal risk-management strategies. It’s like an airbag or seat belt in a car – ideally you should be avoiding crashes in the first place, and it’s really only there as a precaution if things don’t go your way.

If you’ve found value in this post and you’d like to learn a little more about how the fundamental ways I mitigate risk with my stock investing and trading, I’d like to invite you to my FREE Online Masterclass.

It goes for 90 minutes, and in it, I’ll share with you two of my favourite ways to manage risk with my stock investments and trades. You can click to register for it here if that’s of interest to you.

Hope to see you there – either way, best of luck in your journey!

Terry