Over the span of my career as an investor and hedge fund manager, I have seen 2 types of beginners in the stock market.

The first doesn’t believe in their own abilities. They’ll think and say things like:

- “I’m no genius like Warren Buffett”

- “There’s no way I could be on the same level as the top billion-dollar fund managers”

- “I’m not smart enough”

The second kind gets excited with their initial success and starts believing they’re better than some of the world’s best fund managers.

For example, a newbie in the markets might get a 25% return from the first stock they buy after applying some principles they read in a book and immediately think they’re a genius that’s going to be hailed as “the next Warren Buffett”.

…only to find out a little later (usually once they’ve lost all their lucky streak profits), that they may have overestimated their own abilities.

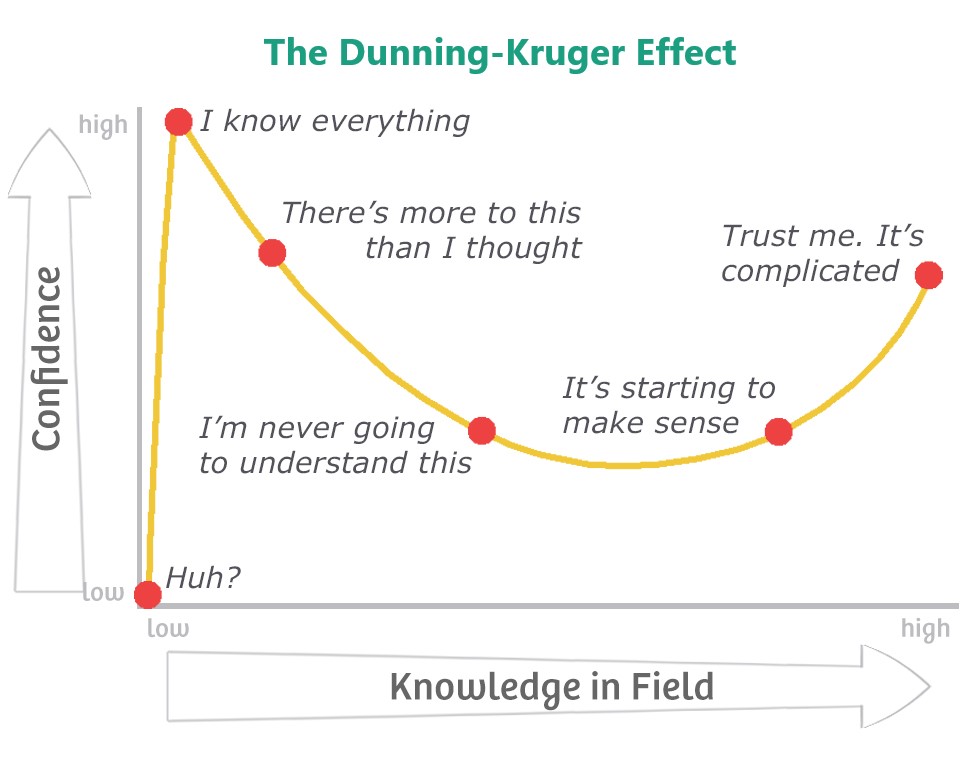

In psychological terms, this is referred to as the Dunning-Kruger effect, which is where people of low ability mistakenly assess their own ability as greater than it actually is.

Regardless of which boat you may sit in, the truth is, if you’re an average everyday investor, your chances of standing up to the best fund managers are quite low.

Why It’s Hard To Beat Smart Money

Here’s why…

Beginner traders with an over-inflated sense of confidence in their abilities (not to mention ego) often don’t understand that they’re not just up against the ‘face’ of institutional investors and managed funds (e.g. Ray Dalio of Bridgewater, Bill Ackman of Pershing Square and Carl Icahn).

These fund managers have teams of investment analysts (sometimes computers with pre-programmed algorithms) that help them identify and research the best investment and trading opportunities.

To highlight the reality of this situation, imagine you’re sitting at home alone doing your own research on opportunities to buy and sell stocks.

Now imagine going against this whole team of experienced and university-qualified investment analysts working full-time discussing and sharing opportunities at Bridgewater Associates (Ray Dalio’s fund)…

The difference in resources is clear. The chances of individual investors beating institutions and managed funds (also known as ‘Smart Money’) is minuscule.

How To Take Advantage Of Smart Money

Just because you’re not ‘Smart Money’, doesn’t mean you’re at a complete loss, however.

You may not have billions of dollars under management, nor do you have a team of 1500 employees helping you do your research.

But you can make use of ‘Smart Money’ resources, and here’s how…

Many managed funds in the US market have requirements from the SEC (Securities Exchange Commission) to disclose their holdings every quarter. This also includes individual investors (e.g. Bill Gates) who hold more than 5% ownership in any particular company.

With this information, you can then use them as a ‘reference guide’ to give you more confidence behind your own investment and trading decisions.

For example, imagine you’re about to place $5,000 into buying a share of a company, and you find out that Warren Buffett or Bridgewater Associates is also buying into the same stock – only they’re buying $100 million (or even $1 billion) worth of this stock instead.

That gives you that extra bit of confidence, doesn’t it?

So in summary, while you can’t be Smart Money, you can use Smart Money to your advantage.

You just have to make sure you conduct your own research first and then treat Smart Money as extra confirmation of your buying and selling decisions, rather than just blindly copying the trades of successful fund managers.

Terry