Have you ever invested in something and then gone to bed unable to sleep at night worrying about whether you’ll get your money back?

This is usually what happens when stock investors and traders risk too much of their capital on a single trade – or, in professional terms, don’t manage their position sizes properly.

So what is position sizing? How does it help you with your stock investments and trades, and how can you use it to your advantage?

Read on and learn how to keep your stock portfolio intact while sleeping like a baby at night.

What Is Position Sizing?

Position sizing is the process of allocating the right amount of capital to each trade or investment.

It’s a risk management technique that helps you control your overall exposure to risk, and therefore allows you to sleep soundly at night even if you have a few losing trades.

The idea behind position sizing is simple: by capping your potential losses on each trade, you protect your capital so that you can stay in the game and continue investing and trading another day.

If you’ve ever heard of the saying “don’t keep all your eggs in one basket,” and the need to diversify your risk with investments, position sizing is how you implement that principle.

How Does Position Sizing Work?

There are two main ways to determine how much capital to allocate to each trade:

- fixed percentage

- fixed dollar amount

Fixed Percentage Position Sizing

With the fixed percentage method, you decide on a percentage of your portfolio that you’re comfortable with risking on each trade. For example, you may decide to risk 2% of your portfolio per trade.

This means that if you have a $10,000 portfolio, you would allocate $200 per trade – in other words, you have a “position size of $200”. If your portfolio increases to $15,000 your position size would increase accordingly, to $300.

Fixed Dollar Position Sizing

With the fixed dollar amount method, you simply decide on a dollar amount that you’re comfortable with risking per trade.

So using the same example, you may decide to risk $200 per trade regardless of your portfolio size.

Which Position Sizing Method Is Best?

There’s no right or wrong answer here – it depends on your personal preferences and portfolio size. Here are my personal thoughts on the matter:

If Your Account Is Larger than $20,000

If your account is larger than $20,000 then the fixed percentage method of position sizing is a good fit for you. This is what I’m currently using, and I like it because it allows me to adjust for any changes in my account.

In other words, my position sizes will go up if my overall capital increases, allowing me to take bigger bets with each position I take in a stock. It also means if my account dips, the size of my positions will also reflect that.

If Your Account Is Smaller than $20,000

If your portfolio is less than $20,000, you may want to consider using the fixed dollar method of position sizing.

The reason why I say this is because with a smaller account, your brokerage costs alone could eat up any profits you make, and it will be difficult to purchase a lot of blue-chip stocks like Amazon or Google.

For example, if you use the same position sizes as me (0.5 – 1%) and you’ve only got a $1,000 portfolio, then you’re only able to buy $5-10 of stock each time, which doesn’t give you a lot of options – unless you use something called fractional shares (a method of ‘buying’ stocks in smaller increments), which has its own downsides.

If you’re just beginning and you’re in this boat of having less than $20,000 to start with, you can start with a fixed dollar position size of $100 – $200 until you reach the $20,000 stage.

➜ Related Article: How Much Money Do I Need to Start Investing or Trading Stocks?

How I Use Percentage Position Sizing For My Stock Investments and Trades

For me, I use position sizes of 0.5% to 1%.

This might seem a little strange to you that I have a range instead of a specific number, but there’s a reason for this. The way I approach position sizing is I adjust the percentages based on market risk. It’s quite simple:

- If the market is volatile and risky, I use smaller positions sizes.

- If the market is low in risk, I’ll use larger position sizes.

This is the third, and lesser known method of position sizing called risk-based position sizing.

If you’re unsure how you can assess market risk, you can learn my ‘traffic light’ market-risk assessment system here.

Why Do I Have 0.5% – 1% For My Position Sizes?

Now, my percentages of 0.5% to 1% may seem quite small to you, but there’s a couple of reasons why I’ve chosen this.

I Don’t Like Taking Unnecessary Risks

The first reason is I don’t like taking unnecessary risks. By using smaller position sizes, I’m able to minimize my risk while still giving myself the opportunity to make decent profits.

When I first started investing and trading in stocks, I attended a trading seminar where we were taught by a ‘guru’ to split our accounts into 5 equal slots of 20% for each high-risk option trade (I was leveraging at the time). Although I was a beginner, even I thought 20% was very risky. So I thought I’d tweak his rules and dial it down to 10%, meaning I had 10 equal slots.

But even that was too much. Following that, I ended up blowing 3 accounts and losing $100,000 in 18 months – everything that I’d saved from my corporate job at the time. Looking back, I can’t believe I even thought 10% per position was OK.

And you guessed it, that ‘guru’ I learned from is no longer around.

I Can Still Be Very Profitable With Small Position Size Percentages

The second reason I use smaller percentages is because it’s still possible to be profitable even if you’re using small position sizes.

This is because of a couple of things:

- I focus on percentages for my returns, not dollar amounts

- I have a long-term view that prioritises preserving my capital and lets compounding do its magic

- I have many portfolio protection mechanisms in place on top of position sizing that allows me to minimise my losses (I share some of these mechanisms in my online masterclasses).

Adding all those factors together, I am able to consistently compound my returns without going into significant account drawdown when the markets inevitably crash.

If you’re not sure what I mean, allow me to demonstrate this visually…

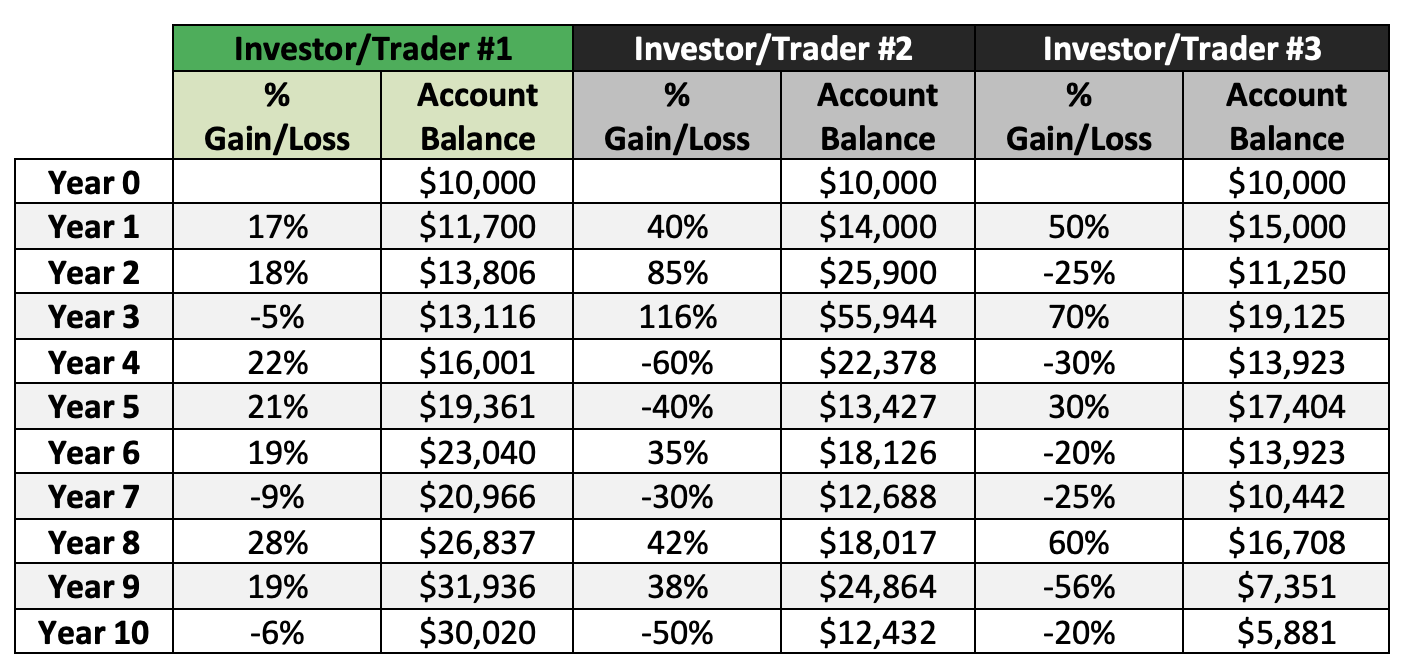

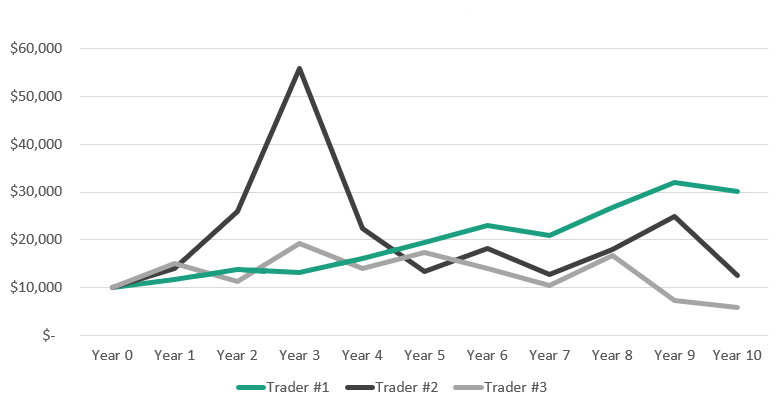

Here, you will see a table and line graph with the returns of 3 different investors/traders.

As you can see, while Investor/Traders #2 and #3 can have higher returns than Investor/Trader #1, they are less consistent, and are just as susceptible to experiencing large losses as they are with large wins.

Imagine the emotional rollercoaster you would experience.

For me personally, I much prefer to be Investor/Trader 1 without question. This is not merely because they have a dramatically higher compounded return when the 10-year time period ends, but also because their performance is more consistent and I can sleep well at night.

When the majority of traders first start out, Trader #2 or #3’s scenario is often what they aim for. However, it is clear that they will in all probability never reach that kind of success because most either blow-up or quit when big losses start to occur and most cannot emotionally handle this.

Does Having 1% Position Sizes Mean I Have 100 Different Stocks?

A common question that pops up when I tell people I use 1% position sizes is,

“Does that mean you have 100 different stocks in your portfolio?”

The short answer is no.

Just because I have 100 different slots, doesn’t mean I have 100 different stocks. It also doesn’t mean all 100 slots are in use at all times.

Rather, I can choose to add more positions of the same stock, or decrease the number of positions I’m holding – depending on market conditions, the stock’s performance, and just what opportunities are available at any point in time.

In fact, it’s quite rare that I have all 100 slots taken up. The only time when that might happen is when all my indicators are greenlit to go after a major market dip (like news of Brexit in June 2016).

What Factors to Consider When Choosing a Position Size

Now that you know how I personally approach position sizing, let me share with you a few factors to consider when choosing your own position size. These are the 3 main factors:

1) How much experience do you have?

This is definitely the number one factor to consider when determining your position size. The more experience you have, the more comfortable you are with risk, and the more likely you are to make money in the stock market.

If you’re a beginner, I would suggest starting with smaller position sizes and only increasing your position size once you’ve become more comfortable and have made some consistent profits.

2) What is your stock investing/trading strategy?

Your stock trading strategy will also dictate what position size is appropriate for you.

For example, if you’re more of a shorter-term trader, then your position size will be much smaller than if you’re a buy-and-hold investor who holds positions for years.

This is because shorter-term trades are generally much more risky than longer-term ones – they are more sensitive to market fluctuations and require a higher level of timing accuracy. Whereas you can be more patient with longer-term investments.

3) How much risk are you comfortable with?

This is a personal preference and will differ from person to person. Some people are OK with losing 20% of their account, while others can’t bear to lose more than 5%.

It’s important to figure out what your risk tolerance is before deciding on a position size. Once you know how much risk you’re comfortable with, you can start to allocate an appropriate percentage for each trade.

For me and my students – it’s somewhere between 0.5% to 2%. For you, it may be more or less.

Summary

To sum it up, position sizing is an important part of stock trading that should not be overlooked.

By following the principles of position sizing, you can manage your risk, protect your capital, and sleep soundly at night knowing your portfolio is intact – even when the stock market is crashing.

If you’re just starting out, I suggest using small position sizes (0.5% – 1%) and increasing them gradually as you become more comfortable with investing and trading. If your portfolio size is smaller than $20,000 it might be best to stick to a fixed dollar position sizing method first.

Also remember to factor in your stock trading strategy and risk tolerance when choosing a position size.

Terry