What’s the best way to make a healthy profit on a trade?

To enter at the very bottom, and exit at the very top – right?

While that does sound great in theory, in reality, it’s a very difficult feat to accomplish.

Does it happen?

Yes, definitely – but when it does, it’s almost certainly due to luck rather than skill.

Why It’s Silly to Aim for the Very Bottom and Very Top

The price of a stock is determined primarily by the economic principle of supply and demand.

And what drives that behaviour comes from many unpredictable sources.

A company might suddenly lose its patent, or surprise the public with the release of a ground-breaking product. Perhaps even a worldwide event like a pandemic could occur, wiping out several industries at once. The possibilities are endless.

For this reason, it’s very difficult to truly know when the very bottom or very top of a stock’s price is, at any point in time.

You might think that a stock has reached the bottom, so you buy into it. But then the next day it drops even more.

Or you might think it’s reached the peak, so you sell it, only to have it continue going up the next day.

Or you might be right with your expectations – it could go either way.

But by doing this you are simply playing a guessing game – something you should never do when putting your money into the stock market.

Here’s How You Can Maximize Your Entry and Exit Timing

While you can’t buy in at the very bottom and exit at the very top of a stock price, you can come pretty close to it.

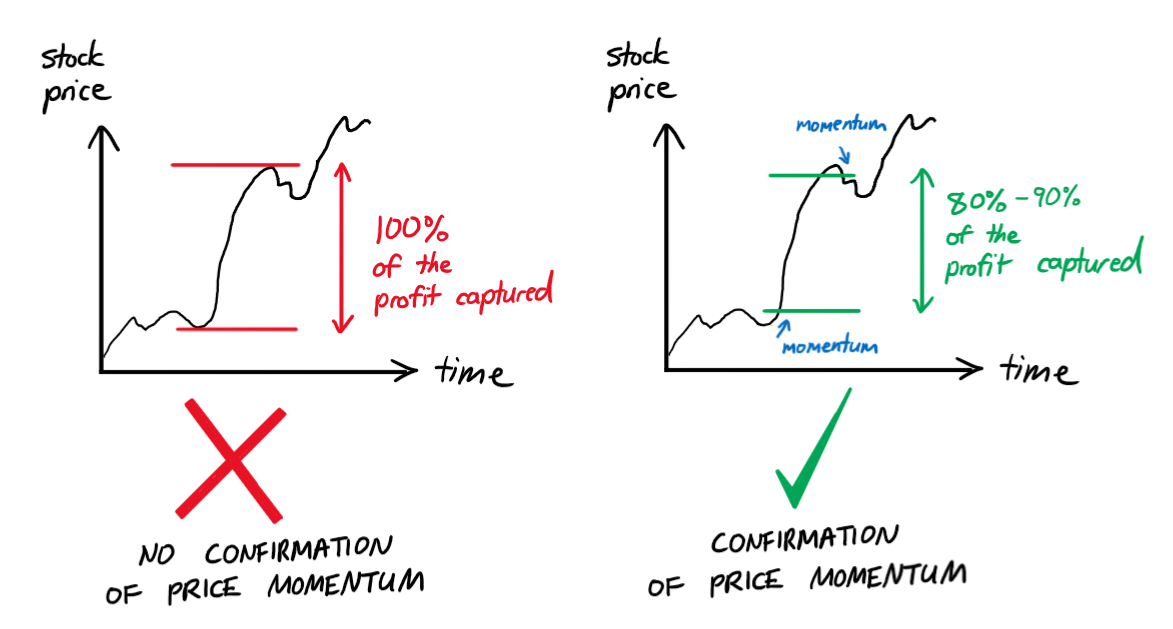

Rather than capturing the full 100% of the increased price movement of a stock, you can tap into about 80-90% of it – which in my books is pretty good, especially when you’re doing it over and over again.

(By the way, this is actually how the best investors and traders become very wealthy over time).

How?

It’s simple – by looking for signs of momentum before confirming your buying and selling decision.

By doing this, you can have more certainty that you have bought close to the bottom and sold close to the top.

Here’s a diagram to demonstrate:

As you can see on the right diagram, you are looking for signs (highlighted in blue) that the price is actually moving up or down before deciding to buy or sell.

By doing this, you’re more likely to sleep well at night instead of tossing and turning in bed, unsure of whether you’ve actually bought in or sold out at the right time.

So to summarize, the next time you’re looking at when to buy or sell, it’s best to look for signs of momentum first before deciding.

Terry

P.S Whenever you’re ready… here are 2 ways where I can help you accelerate your wealth in a risk-managed way:

1. Grab a free copy of our 10 Step Stock Checklist

It’s the road map to selecting what I personally consider the very best stocks while avoiding the bad ones and growing your wealth. – Click Here

2. Join our free upcoming live online investment and trading Masterclass and learn a tonne!

Let me first tell you what it’s not. It’s not some short 45 min training where I show you some stuff and try to sell you something.

It actually goes on for a full 2 hours where I really teach, so make sure you have the time, turn up and want to learn.

It’s all about how to create real-life freedom without taking silly risks. No BS, no hype, just real training so you can invest and trade with confidence – Click Here