It’s never too early to start planning for your child’s future. In fact, if you want to help them become millionaires, the time to start is now. That’s because stock investing is one of the best ways to build wealth over time.

Is It Even Possible For My Child To Become A Millionaire?

Having read the title of this blog, you may be sceptical. After all, the term “millionaire” is typically associated with wealthy adults who have either inherited their millions or earned them through business and entrepreneurship. But the fact is, given enough time, anyone – particularly children – can become a millionaire through stock investing and the power of compound interest.

There are a few reasons why stock investing is such a powerful tool for building wealth. First, stocks have the potential to generate healthy returns over time. For example, the S&P 500 – a popular stock market index that tracks the performance of 500 large publicly-traded companies – has averaged an annual return of around 10% over the last few decades.

That might not seem like much, but thanks to the power of compound interest, over a period of 30 or 40 years, those gains can really add up. In fact, if you had invested $10,000 in the S&P 500 in 1980, your investment would be worth over $1 million today.

Of course, there’s no guarantee that stocks will continue to perform as well as they have in the past. But even if stock prices only rise by a few percent each year, that can still add up to a lot of money over time – especially if you start investing early.

And so it’s important for parents to begin teaching their children about the importance of stock investing at an early age. Doing so can help set them up for financial success later in life.

The Financial Psychology of the Typical Teenager / Young Adult

Teaching kids to be responsible with money can be challenging.

Do you remember what your relationship with money was like when you were a teenager or young adult? For many of us, it was a time when we thought we were invincible and money was no object. We spent without thinking about the future and often ended up in debt.

Even for those of us that were a bit more conservative – we know how tempting it is to spend that first paycheck. After all, our friends are spending theirs and buying new clothes, cars and other exciting things. Why would we want to forego that and invest? It sounds boring.

Even so, is it worth doing it at a young age? Absolutely.

The good news is, as a parent, you can help your kids get started on the path to financial success. Here’s how…

5 Tips To Help Set Up Your Kids’ Financial Future

1. Talk to your kids about money and investing

One of the most important things you can do is talk to your kids about money. Explain to them how investments work and why it’s important to start planning for their future now. I’ll give you an example later on of how to get your kids to buy into the idea of investing.

2. Get them involved in the process

If your kids are old enough, involve them in the process of picking stocks. This will help teach them about research and analysis. It’s also a good way to get them interested in the stock market. This is what many of our Blueprint community members do.

3. Help them set up a savings and investment plan

Once you’ve talked to your kids about the importance of investing, it’s time to help them set up a savings and investment plan. This will ensure that they’re regularly putting money away for their future.

4. Share a few examples of stocks that would be good for them to invest in

If your kids are interested in stock investing, share a few examples of good stocks for them to consider investing in. One of the best ways to do this is to talk about the companies that create the goods and services that they personally use – for example, if they’re into video games, you could discuss the gaming industry; if they’re into fashion, you could discuss the apparel industry, and so on. This will help teach them about the different types of stocks that are available.

5. Monitor their progress and adjust as needed

It’s important to monitor your kids’ progress and make adjustments to their investment plan as needed. This will help ensure that they’re on track to reach their financial goals.

How To Get Your Kids To Buy Into The Idea Of Investing

To get kids to buy into this notion, it helps to provide them with a real-world example of how starting early can start them on the path to being millionaires.

Here’s an example to give your kids:

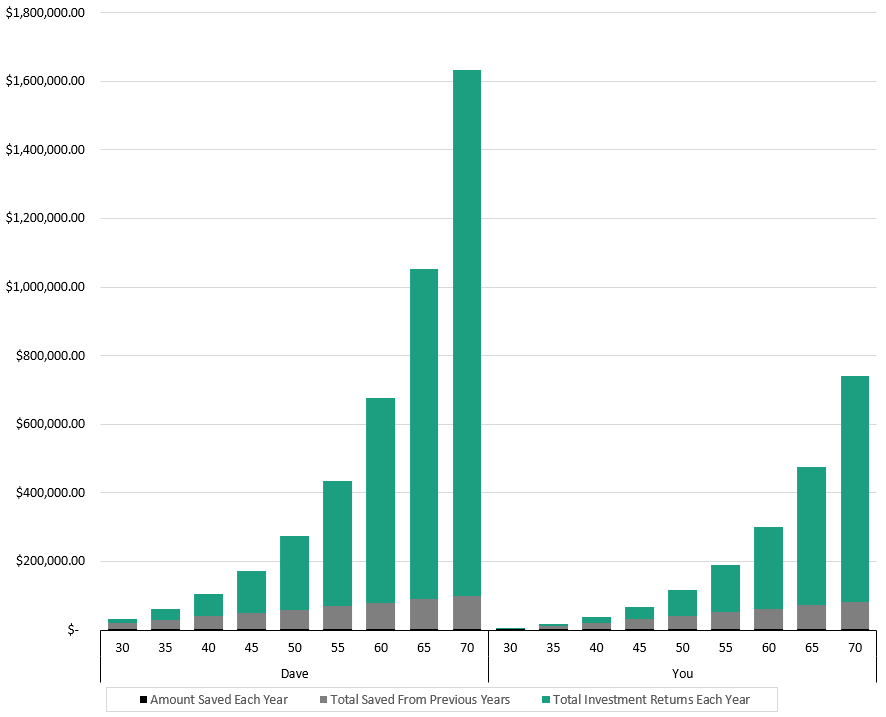

You and your friend, Dave, are both good students and have part-time jobs. However, you like to spend rather than save the money you earn. Dave is much more focused on saving his money and starting at age 20, he was able to put aside $38 a week or $2,000 annually. Unlike you, Dave invests his savings and has returns of 9% a year (the 30-year average return for global stocks.)

It is now 10 years in the future and you are both age 30. You decide to start investing and like Dave, you invest $2,000 annually. You also receive a 9% return. Since age 20, Dave has only saved $20,000 which isn’t too much for you to catch up to. Or is it?

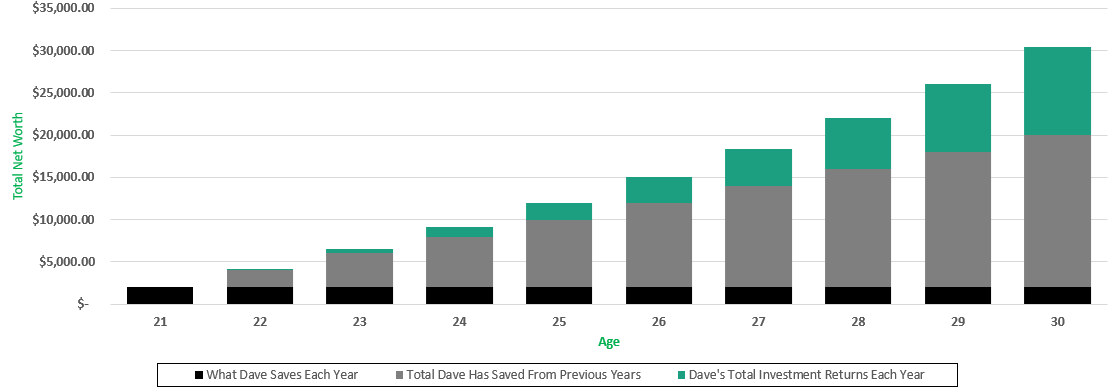

In actuality, Dave is way ahead of you. Since Dave got an early start, compound interest has already begun working its magic and it will continue to do so for the rest of his life. That’s because his interest will gain interest each year and that means more savings as time progresses. In just 10 years, Dave has amassed over $10,000 in interest alone (see below in the green bars).

Let’s now take a look at you and Dave at age 70. Your friend who you thought was not much further along at age 30 is now $1 million dollars richer than you. He only saved an additional $20,000, but with compound interest, that $20,000 grew into a $1.6 million (whereas your $20,000 grew into just a little over $738,000 — less than half of Dave’s portfolio).

You can see the difference in the graph below…

My point is, the sooner you start, the more money you will earn by letting compound interest work for you.

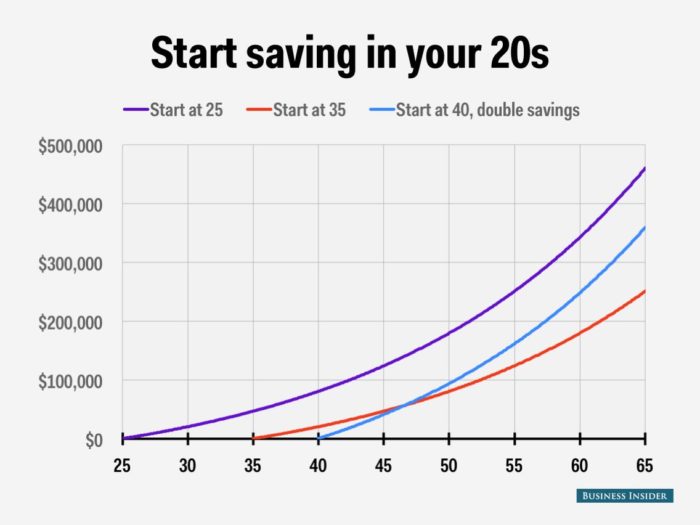

Another perspective of looking at this is, the later you start, the harder you have to work to achieve your financial goals (see diagram below):

Other Advantages To Investing Early

There are other advantages for teaching our kids to invest early. Longer-term investments have a much better outlook for returns because over time the ups and downs of the market generally balance out.

If your kid makes a mistake, which is likely at some point, time is on their side and they will eventually recover. An investor who is aged 60 is going to have a much harder time recovering from a 30% loss than a 30-year-old. Also, when you are starting off, your portfolio is smaller. Making a mistake is not as devastating as it is when it has grown larger.

As with most things in life, investing requires a learning process. When we start early, we have more time to learn the right way to invest and develop financial discipline. It is much easier to do this before we have the responsibilities of a family to support or a mortgage to pay.

We also benefit from having a sense of financial security. The knowledge that we have ample funds to withstand tough times can greatly reduce our stress levels and increase our level of confidence. That in turn, can only have a positive influence on other areas of our lives such as relationships with others, our families and job performance.

Understand And Benefit From The 8th Wonder Of The World

Teaching our kids about compound interest is one of the most important lessons we can give them. It’s a lesson that will benefit them for the rest of their lives. Not only will they earn more money, but they’ll also have peace of mind knowing that they have financial security.

When referring to compound interest, Albert Einstein said it was the “eighth wonder of the world.” He added that, “He who understands it, earns it. He who doesn’t, pays it.”

Compound interest will work for us for a lifetime. If you haven’t already, start saving and let it work its magic for you and your kids.

Terry