From January to March 2020, the stock market was chaotic.

A lot of people lost money… unnecessarily.

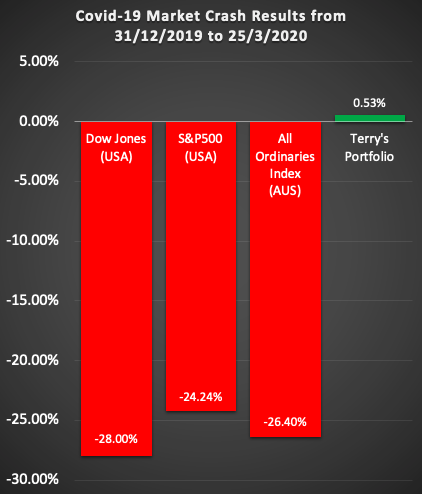

Thankfully, after years of learning from some of the best fund managers on the planet and practicing how to assess the stock market, I was able to not only minimize my portfolio losses, but also make a slight profit of 0.53% while the market tanked completely.

To put things in perspective:

- the S&P500 index dropped by 24.24%

- the Dow Jones decreased by 13.6%.

- the Australian All Ordinaries Index dropped by 26.4%

The truth is, I was able to see this market crash coming.

Obviously, I didn’t know what would eventually cause it (i.e. the domino effect from the coronavirus of 2019-2020 – also referred to as COVID-19), but all the financial indicators told me it was coming.

One of my Blueprint students Bryaan Lea from Singapore asked me shortly after I shared my results:

“How were you able to lose only less than half of one percent and then proceed to profit during this market crash?”

Here was my reply:

The reason I was able to minimize my losses and prepare myself to take advantage of post-market crash bargain prices for stocks was that I’d expected the market correction for months.

And as a result, I followed the exact process I teach all my Blueprint students in Module 3 of our online course (PreVision), which meant:

- Only 25% of my total portfolio was held in stocks – I’d sold off most of my holdings and locked away profits prior to this correction.

- I limited the stocks I had leftover in my portfolio to a maximum of 0.5%-1% position sizes for each take. (One of our Blueprint Protection process rules).

- I shorted the market prior to this, and while all of them were resulting in losses just prior to this period (December to February 2020), most of my shorts held were in massive profit during March and April.

- NOTE: This is something I had to patiently sit through, which most investors cannot do when they experience temporary unrealized losses – they let their emotions get the better of them.

- My stocks were held in USD, as a natural byproduct of investing in the U.S market, provided me with a natural hedge from the value of the Aussie dollar dropping. (This applies to anyone investing in the U.S market that isn’t living in the United States)

- Likewise, 67% of my cash held was in USD, again, providing me with protection from the rapid decline of the Aussie dollar.

It’s as simple as that.

Investing and Trading is meant to Be ‘Boring’, but that’s what makes it Fun and Profitable!

Sometimes I feel like a broken record – I’d been telling as many people as I could that an impending market crash was just around a corner while the market was bullish and everyone was making easy profits.

I didn’t have anything fancy to say. Just the same message over and over again – that the indicators were pointing towards an imminent crash.

For months I harped on about the markets becoming expensive and a crash coming. My warnings were constant. And they were boring.

I didn’t know that the coronavirus COVID-19 would eventually be the trigger for the crash, but I knew for a fact that a crash was coming. It was just a matter of what would eventually tip it all over.

And so my students and I sold out our positions and locked in the majority of our profits in December 2019.

Because that’s the beauty of investing -– if you know and follow the rules, it becomes quite clear and simple.

Always focus on Risk Mitigation first, and the Profits will come

The problem I see with most people that invest and trade in the market (including some investment bankers and full-time traders), is they heavily focus on the profit side, but not the preservation/risk-mitigation side.

As a result, they’re completely vulnerable to the movements of the markets, especially when they’re leveraged with things like CFDs, forex, futures and options.

They’ll make killer returns when the markets are doing really well (i.e. bullish), but they’ll also crash and burn when the markets aren’t doing so well (i.e. bearish).

And as a result, they’ll panic, sell all their positions and make a huge loss on their portfolio. They’ll start to think that “investing is just gambling“, and learn to despise market crashes.

Learn to LOVE Market Crashes

As investors and traders, we must learn to love market crashes because it’s during these times that you are able to achieve high returns with very low risk and in a short space of time.

Something I constantly remind my Blueprint students (and I encourage you to commit to memory) is this:

“A successful investor and trader is not when one who can make money when markets rise. Anyone can do that.

It is when one can minimize their losses during market crashes and have the capacity (mental and cash) to take advantage of panic post carnage while everyone else is losing sleep at night.

This is the true mark of a successful investor and trader.”

Terry Tran

And if you could just master one skill that would make all the difference in your ability to succeed as an investor and trader, I would recommend you master the ability to analyze and assess the markets.

Learn how to fish for yourself. Don’t rely on others.

Too often, I see everyday investors act on ‘hot tips’ they receive from friends, family, and the news, only to be subject to the forces of the market.

Likewise, I’ve seen many families entrust their money to whom they deem as financial experts, only to have the same thing happen.

I sincerely hope that this post has shown you that that doesn’t have to be the case.

If you have found this helpful and insightful, and can think of someone that could benefit from reading this, then please share this with them.

I’m also running a free online Masterclass that dives deeper on how I personally read the markets and prepare for market crashes in advance, plus the criteria I personally use to screen out the best stocks.

It’s a highly interactive class, complete with your own downloadable workbook, and I guarantee you’ll walk out of the Masterclass with a completely different filter of the trading and investing world.

If you’d like to join me, book your spot here, and I’ll see you on the other side.

Terry